Tips To Select A Medicare supplement Plan

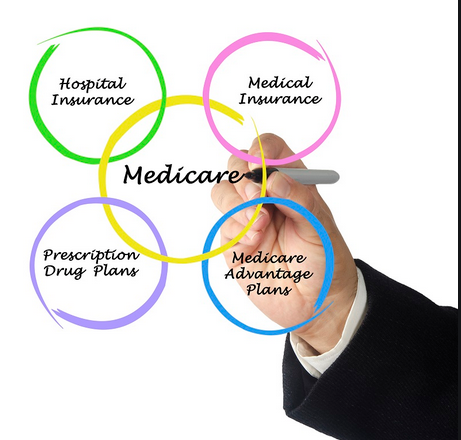

Medicare supplement Plan:

The First Medicare includes lots of openings on it. Best Medicare supplement plans strategies helps cover these openings. It commonly indicates the out-of-pocket expenses, that might be not present from the one. You will find lots of Medigap to fill within this gap. The private companies sell those options. To choose the Best Medicare supplement plans, information in regards to the prevailing Medicare program is imperative. There are two ways in which a person can approach a hospital. You can find twenty five Medicare supplement Plans gift they truly are A, B, D, C, F, F, G, K, L, M, and N.

Benefits coated in each Medigap:

● It satisfies the openings in the Medicare program.

● Copayment and hospice care via Medicare Part A.

● It provides coinsurance of Medicare Part A.

● Coinsurance of Medicare Part B.

● Copayments of Medicare Part b.

● In almost any medical crisis, it supplies the First three pints of bloodflow.

Choosing the best Medicare supplement Approach:

A few Plans restrict the expense on out of pocket cost. One Needs to consider the following factors while Deciding upon the finest Medicare supplement Strategy :

● Low monthly premiums – If anybody would be Searching for a plan having a reduced monthly premium, Plan G is your optimal/optimally choice.

● Add-ons with Component B – If a patient desires To opt for a plan for Section B deductibles, Plan C and F will be perfect satisfied to Program K and program L comprise 50 percent and 75 per cent of their co payments of Part B, respectively.

● Maximum Possible Coverage – To choose a Plan with the most coverage, one needs to select Plan F offered by a few far better organizations. Its all-inclusive source is very beneficial.

On Select a Medicare supplement strategy, a patient should be attentive to the limits of every strategy. The obligations which the company requires supplying these programs are monthly premiums and yearly deductibles.